USDA Announces Additional Assistance for Cattle, Row Crop Producers

Author

Published

4/7/2021

USDA announced today more than $12 billion for the Pandemic Assistance for Producers, which will help farmers and ranchers who previously did not qualify for COVID-19 aid and expand assistance to farmers who have already received help. Farmers who previously submitted CFAP applications will not have to apply again. Sign-up for the new program begins on April 5.

Background

The last COVID-19 stimulus package of 2020, passed by Congress on Dec. 21, contained much-needed financial relief for agricultural producers. The bill’s agricultural provisions included additional assistance for producers, contract growers and producers who had to depopulate animals, supplemental coverage for Dairy Margin Coverage, and additional inventory payments for livestock producers. On Jan. 15, USDA announced that it would be moving forward with programs for selected provisions of the bill, including allowing contract growers to apply for assistance under CFAP 2 and updating the payment calculations for certain crops. Upon assuming office, the new administration put a hold on all of these last-minute programs (a common practice for incoming administrations) and put the new CFAP program under review. Today, USDA announced the review was complete for select commodities and released some details of its plans to distribute more than $12 billion under the Pandemic Assistance for Producers. These updates include reopening the Coronavirus Food Assistance Program 2 (CFAP 2), additional payments for eligible cattle and row crop producers, and the processing of payments for certain applications filed as part of CFAP Additional Assistance. USDA’s Farm Service Agency will accept new and modified CFAP 2 applications beginning April 5.

Assistance for Non-Specialty and Specialty Crops

Price Trigger and Flat-Rate Crops

USDA has expanded direct financial assistance for commodity producers with the intent to expedite payments totaling more than $4.5 billion, impacting more than 560,000 producers. Producers of 2020 price trigger crops and flat-rate crops are eligible to receive a payment of $20 per eligible acre of the crop. Price trigger commodities, as defined in the second Coronavirus Food Assistance Program, are major commodities that meet a minimum 5% price decline for the week of Jan. 13-17, 2020, and July 27-31, 2020. These crops include barley, corn, sorghum, soybeans, sunflowers, upland cotton and all classes of wheat, among others found here.

Flat-rate crops either do not meet the 5%-or-greater national price decline trigger or do not have data available to calculate a price change. For flat-rate crops, CFAP 2 payments were calculated based on eligible acres of the crop planted in 2020. More than 230 fruit, vegetable, horticulture and tree nut commodities were eligible for CFAP 2 along with honey, maple sap, and turfgrass sod; more information can be found here. These commodities will also receive a payment of $20 per acre.

Eligible producers will not need to reapply or submit a new application if they submitted a CFAP 2 application. FSA will automatically issue payments to eligible price trigger and flat-rate crop producers based on the eligible acres included in their CFAP 2 applications.

Expanded Assistance to More Producers

USDA is dedicating $6 billion to develop new programs or modify existing proposals that were included as discretionary funding in the end-of-year COVID-19 stimulus package. USDA is making modifications to direct support payments to account for price differentiation among commodities, including costs for organic certification or to continue or add conservation activities.

USDA will also make available an additional $100 million in Specialty Crop Block Grants that are administered through each state’s Department of Agriculture, along with an additional $100 million for the Local Agriculture Market Program.

Assistance for Processors

USDA is following through on using a portion of the appropriated money for payments to domestic users of upland cotton and extra long staple cotton between March 1, 2020, and Dec, 31, 2020. The payment rate is calculated by multiplying 6 cents per pound by the average monthly consumption of the domestic user from Jan. 1, 2017, through Dec. 31, 2019, then multiplying it by 10, e.g., cotton payment = $0.60 x (avg. monthly consumption Jan 1, 2017-Dec 31, 2019).

Moreover, one of the consequences of COVID-19 precautions and stay-at-home orders was a significant decrease in fuel consumption, which slashed to biofuel demand. Since the beginning of 2020 through mid-December, the cumulative decline in ethanol production is nearly 2 billion gallons. USDA has made payments available to producers of advanced biofuel, biomass-based diesel, cellulosic biofuel, conventional biofuel, or renewable fuel due to unexpected market losses as a result of COVID-19.

Livestock

Contract producers

Many producers were left out of the CARES Act and subsequent CFAP iterations because farmers who raise animals under a contract for another entity that owns the animals could not participate. However, these producers saw their income significantly reduced as many of their barns (which they financed the construction of and still were required to service the debt on) remained empty due to supply chain disruptions earlier in the pandemic. The COVID-19 relief bill passed in December identified these producers as being eligible for support. However, USDA clarified recently that payments for contract growers under CFAP Additional Assistance are currently on hold and are likely to require modifications to the regulation as part of a broader evaluation. FSA will continue to accept applications from interested contract growers during this evaluation period.

Cattle

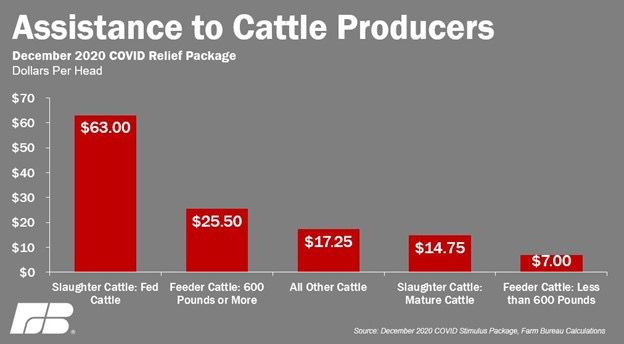

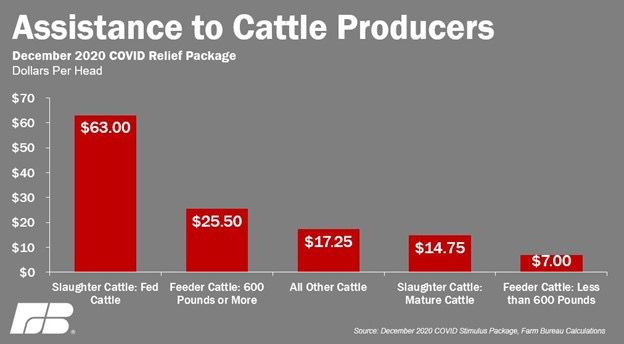

Included in this announcement is additional inventory-based direct payments for cattle producers. USDA is implementing an increase in CFAP 1 payment rates for cattle based on the number of cattle in inventory between April 16, 2020, and May 14, 2020. USDA estimates that roughly 410,000 producers will be impacted by this and that the total level of support could equal roughly $1.1 billion. These payments will be made automatically, so there will be no need for producers who were already enrolled to reapply. Only producers who previously applied for CFAP 1 are eligible to receive this additional payment. Payment rates are detailed in the following figure.

Depopulated Animals

As a result of significant supply chain disruptions, some producers were forced into the heart-wrenching position of having to euthanize their animals. This is the last resort. Farmers do everything they can to avoid this outcome, but in such a tightly coupled delivery system, they were threatened with going out of business having raised animals they could no longer sell. The COVID-19 relief bill passed in December directed the Agriculture Secretary to make payments to producers for losses incurred due to the depopulation of livestock and poultry due to insufficient processing access. The bill laid out that these payments will be up to 80% of the fair market value of the depopulated animals, and for the costs of depopulation. Note: This announcement does not detail support for these producers, and Secretary Vilsack stated that USDA will need to develop programs to reimburse these producers as they were not covered by the previous programs being utilized to make this round of payments.

Swine

The information released by USDA on Jan. 15 said swine producers who participated in CFAP 1 would receive an automatic “top-up” payment of $17 per head, increasing the total CFAP 1 inventory payment to $34 per head. However, additional CFAP 1 payments for swine producers are currently on hold and are likely to require modifications to the regulation as part of a broader evaluation.

Other

There were a series of formula adjustments included in the Jan. 15 announcement that are included in today’s announcement. USDA will finalize routine decisions and minor formula adjustments on applications and begin processing payments for certain applications filed as part of the CFAP Additional Assistance program. Included in those applications for which payments will be processed are pullets (poultry) and turfgrass sod. For specialty crop producers, USDA is modifying the sales-based rules from CFAP 2 to allow specialty crop producers to include crop insurance indemnities and disaster payments in their 2019 sales, which was the basis for determining the amount of support under CFAP 2, or by substituting 2018 sales.

FSA also adjusted the CFAP 2 payment calculation for certain row crops, addressing an issue that existed for producers who had crop insurance coverage but did not have a 2020 actual production history-approved yield. Now, when APH is not available, FSA will use 100% of the 2019 Agriculture Risk Coverage-County benchmark yield to calculate payments, instead of the 85% the earlier CFAP 2 calculations required.

Moving forward

Through a new initiative, USDA Pandemic Assistance for Producers, USDA is aiming to reach a broader set of producers than in previous COVID-19 aid programs. USDA is dedicating at least $6 billion for the new programs. The Department will also develop rules for new programs that will put a greater emphasis on outreach to small and socially disadvantaged producers, specialty crop and organic producers and timber harvesters, as well as provide support for the food supply chain and producers of renewable fuel, among others. Existing programs like CFAP will fall within the new initiative and, where statutory authority allows, will be refined to better address the needs of producers.

USDA reopened CFAP 2 sign-up to improve access and outreach to underserved producers. As part of this announcement, USDA committed at least $2.5 million to establish partnerships and direct outreach efforts intended to improve outreach for CFAP 2. USDA will cooperate with grassroots organizations with strong connections to socially disadvantaged communities to ensure they are informed and aware of the application process.

Conclusion

USDA announced recently its plans to distribute more than $12 billion for the Pandemic Assistance for Producers, which will help farmers and ranchers who previously did not qualify for COVID-19 aid and expand assistance to farmers who have already received help. Additional sign-ups will not be necessary for those who previously submitted CFAP applications. The funding includes $6 billion to develop new programs or modify existing proposals using remaining discretionary funding from the Consolidated Appropriations Act. Another $5.6 billion will be directed to formula payments to cattle producers and eligible flat-rate or price trigger crops. In addition, $500 million in new funding is included for existing programs such as the Specialty Crop Block Grant Program, Farmers Opportunities Training and Outreach Program, Local Agricultural Marketing Program, Gus Schumacher Nutrition Incentive Program, Animal and Plant Health Inspection Service, Agricultural Research Service, National Institute of Food and Agriculture and the Economic Adjustment Assistance for Textile Mills Program. Sign-up for the new program begins April 5. USDA’s announcement can be found here.

Background

The last COVID-19 stimulus package of 2020, passed by Congress on Dec. 21, contained much-needed financial relief for agricultural producers. The bill’s agricultural provisions included additional assistance for producers, contract growers and producers who had to depopulate animals, supplemental coverage for Dairy Margin Coverage, and additional inventory payments for livestock producers. On Jan. 15, USDA announced that it would be moving forward with programs for selected provisions of the bill, including allowing contract growers to apply for assistance under CFAP 2 and updating the payment calculations for certain crops. Upon assuming office, the new administration put a hold on all of these last-minute programs (a common practice for incoming administrations) and put the new CFAP program under review. Today, USDA announced the review was complete for select commodities and released some details of its plans to distribute more than $12 billion under the Pandemic Assistance for Producers. These updates include reopening the Coronavirus Food Assistance Program 2 (CFAP 2), additional payments for eligible cattle and row crop producers, and the processing of payments for certain applications filed as part of CFAP Additional Assistance. USDA’s Farm Service Agency will accept new and modified CFAP 2 applications beginning April 5.

Assistance for Non-Specialty and Specialty Crops

Price Trigger and Flat-Rate Crops

USDA has expanded direct financial assistance for commodity producers with the intent to expedite payments totaling more than $4.5 billion, impacting more than 560,000 producers. Producers of 2020 price trigger crops and flat-rate crops are eligible to receive a payment of $20 per eligible acre of the crop. Price trigger commodities, as defined in the second Coronavirus Food Assistance Program, are major commodities that meet a minimum 5% price decline for the week of Jan. 13-17, 2020, and July 27-31, 2020. These crops include barley, corn, sorghum, soybeans, sunflowers, upland cotton and all classes of wheat, among others found here.

Flat-rate crops either do not meet the 5%-or-greater national price decline trigger or do not have data available to calculate a price change. For flat-rate crops, CFAP 2 payments were calculated based on eligible acres of the crop planted in 2020. More than 230 fruit, vegetable, horticulture and tree nut commodities were eligible for CFAP 2 along with honey, maple sap, and turfgrass sod; more information can be found here. These commodities will also receive a payment of $20 per acre.

Eligible producers will not need to reapply or submit a new application if they submitted a CFAP 2 application. FSA will automatically issue payments to eligible price trigger and flat-rate crop producers based on the eligible acres included in their CFAP 2 applications.

Expanded Assistance to More Producers

USDA is dedicating $6 billion to develop new programs or modify existing proposals that were included as discretionary funding in the end-of-year COVID-19 stimulus package. USDA is making modifications to direct support payments to account for price differentiation among commodities, including costs for organic certification or to continue or add conservation activities.

USDA will also make available an additional $100 million in Specialty Crop Block Grants that are administered through each state’s Department of Agriculture, along with an additional $100 million for the Local Agriculture Market Program.

Assistance for Processors

USDA is following through on using a portion of the appropriated money for payments to domestic users of upland cotton and extra long staple cotton between March 1, 2020, and Dec, 31, 2020. The payment rate is calculated by multiplying 6 cents per pound by the average monthly consumption of the domestic user from Jan. 1, 2017, through Dec. 31, 2019, then multiplying it by 10, e.g., cotton payment = $0.60 x (avg. monthly consumption Jan 1, 2017-Dec 31, 2019).

Moreover, one of the consequences of COVID-19 precautions and stay-at-home orders was a significant decrease in fuel consumption, which slashed to biofuel demand. Since the beginning of 2020 through mid-December, the cumulative decline in ethanol production is nearly 2 billion gallons. USDA has made payments available to producers of advanced biofuel, biomass-based diesel, cellulosic biofuel, conventional biofuel, or renewable fuel due to unexpected market losses as a result of COVID-19.

Livestock

Contract producers

Many producers were left out of the CARES Act and subsequent CFAP iterations because farmers who raise animals under a contract for another entity that owns the animals could not participate. However, these producers saw their income significantly reduced as many of their barns (which they financed the construction of and still were required to service the debt on) remained empty due to supply chain disruptions earlier in the pandemic. The COVID-19 relief bill passed in December identified these producers as being eligible for support. However, USDA clarified recently that payments for contract growers under CFAP Additional Assistance are currently on hold and are likely to require modifications to the regulation as part of a broader evaluation. FSA will continue to accept applications from interested contract growers during this evaluation period.

Cattle

Included in this announcement is additional inventory-based direct payments for cattle producers. USDA is implementing an increase in CFAP 1 payment rates for cattle based on the number of cattle in inventory between April 16, 2020, and May 14, 2020. USDA estimates that roughly 410,000 producers will be impacted by this and that the total level of support could equal roughly $1.1 billion. These payments will be made automatically, so there will be no need for producers who were already enrolled to reapply. Only producers who previously applied for CFAP 1 are eligible to receive this additional payment. Payment rates are detailed in the following figure.

Depopulated Animals

As a result of significant supply chain disruptions, some producers were forced into the heart-wrenching position of having to euthanize their animals. This is the last resort. Farmers do everything they can to avoid this outcome, but in such a tightly coupled delivery system, they were threatened with going out of business having raised animals they could no longer sell. The COVID-19 relief bill passed in December directed the Agriculture Secretary to make payments to producers for losses incurred due to the depopulation of livestock and poultry due to insufficient processing access. The bill laid out that these payments will be up to 80% of the fair market value of the depopulated animals, and for the costs of depopulation. Note: This announcement does not detail support for these producers, and Secretary Vilsack stated that USDA will need to develop programs to reimburse these producers as they were not covered by the previous programs being utilized to make this round of payments.

Swine

The information released by USDA on Jan. 15 said swine producers who participated in CFAP 1 would receive an automatic “top-up” payment of $17 per head, increasing the total CFAP 1 inventory payment to $34 per head. However, additional CFAP 1 payments for swine producers are currently on hold and are likely to require modifications to the regulation as part of a broader evaluation.

Other

There were a series of formula adjustments included in the Jan. 15 announcement that are included in today’s announcement. USDA will finalize routine decisions and minor formula adjustments on applications and begin processing payments for certain applications filed as part of the CFAP Additional Assistance program. Included in those applications for which payments will be processed are pullets (poultry) and turfgrass sod. For specialty crop producers, USDA is modifying the sales-based rules from CFAP 2 to allow specialty crop producers to include crop insurance indemnities and disaster payments in their 2019 sales, which was the basis for determining the amount of support under CFAP 2, or by substituting 2018 sales.

FSA also adjusted the CFAP 2 payment calculation for certain row crops, addressing an issue that existed for producers who had crop insurance coverage but did not have a 2020 actual production history-approved yield. Now, when APH is not available, FSA will use 100% of the 2019 Agriculture Risk Coverage-County benchmark yield to calculate payments, instead of the 85% the earlier CFAP 2 calculations required.

Moving forward

Through a new initiative, USDA Pandemic Assistance for Producers, USDA is aiming to reach a broader set of producers than in previous COVID-19 aid programs. USDA is dedicating at least $6 billion for the new programs. The Department will also develop rules for new programs that will put a greater emphasis on outreach to small and socially disadvantaged producers, specialty crop and organic producers and timber harvesters, as well as provide support for the food supply chain and producers of renewable fuel, among others. Existing programs like CFAP will fall within the new initiative and, where statutory authority allows, will be refined to better address the needs of producers.

USDA reopened CFAP 2 sign-up to improve access and outreach to underserved producers. As part of this announcement, USDA committed at least $2.5 million to establish partnerships and direct outreach efforts intended to improve outreach for CFAP 2. USDA will cooperate with grassroots organizations with strong connections to socially disadvantaged communities to ensure they are informed and aware of the application process.

Conclusion

USDA announced recently its plans to distribute more than $12 billion for the Pandemic Assistance for Producers, which will help farmers and ranchers who previously did not qualify for COVID-19 aid and expand assistance to farmers who have already received help. Additional sign-ups will not be necessary for those who previously submitted CFAP applications. The funding includes $6 billion to develop new programs or modify existing proposals using remaining discretionary funding from the Consolidated Appropriations Act. Another $5.6 billion will be directed to formula payments to cattle producers and eligible flat-rate or price trigger crops. In addition, $500 million in new funding is included for existing programs such as the Specialty Crop Block Grant Program, Farmers Opportunities Training and Outreach Program, Local Agricultural Marketing Program, Gus Schumacher Nutrition Incentive Program, Animal and Plant Health Inspection Service, Agricultural Research Service, National Institute of Food and Agriculture and the Economic Adjustment Assistance for Textile Mills Program. Sign-up for the new program begins April 5. USDA’s announcement can be found here.