Utah's Tax Restructuring

Author

Published

6/4/2019

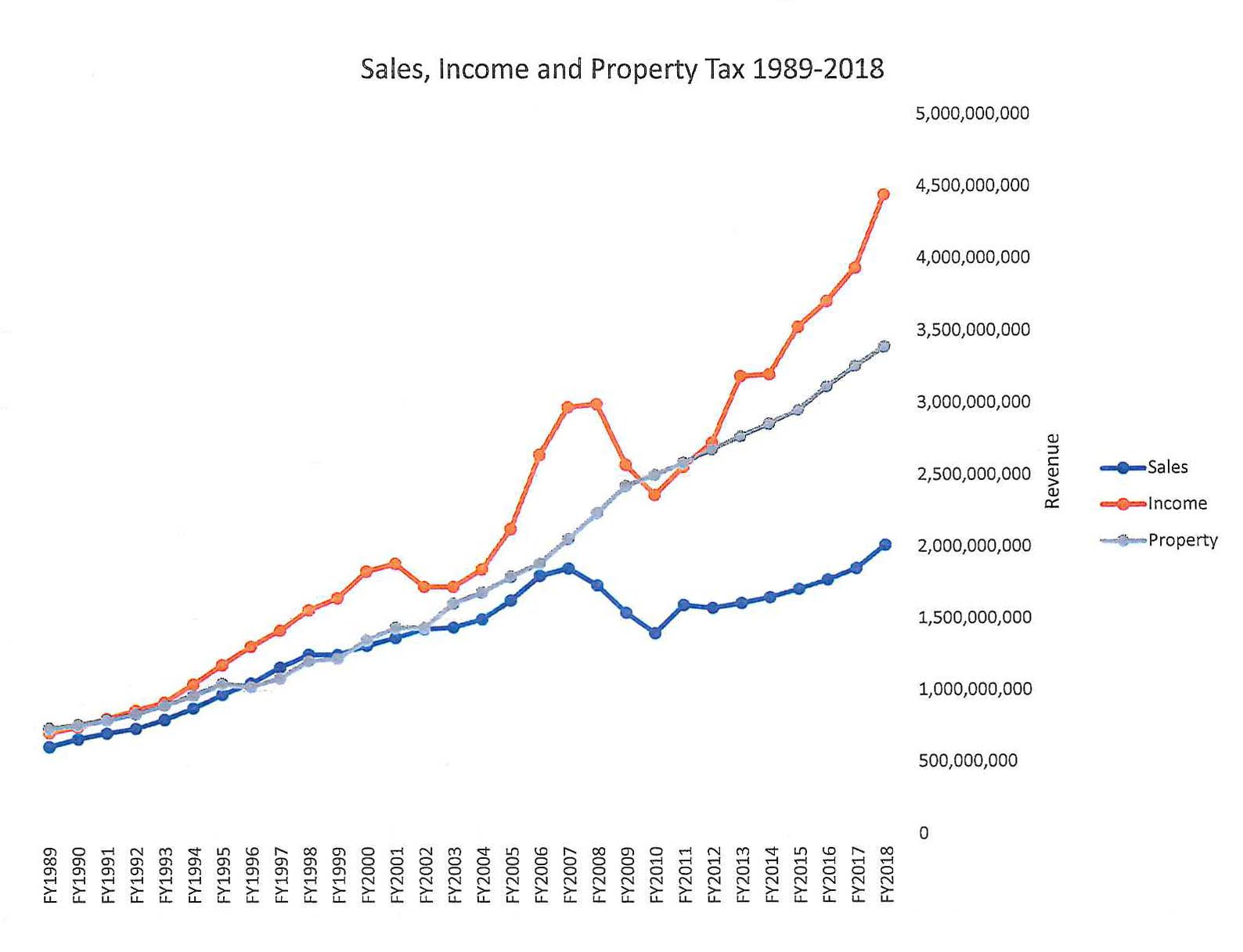

ISSUE

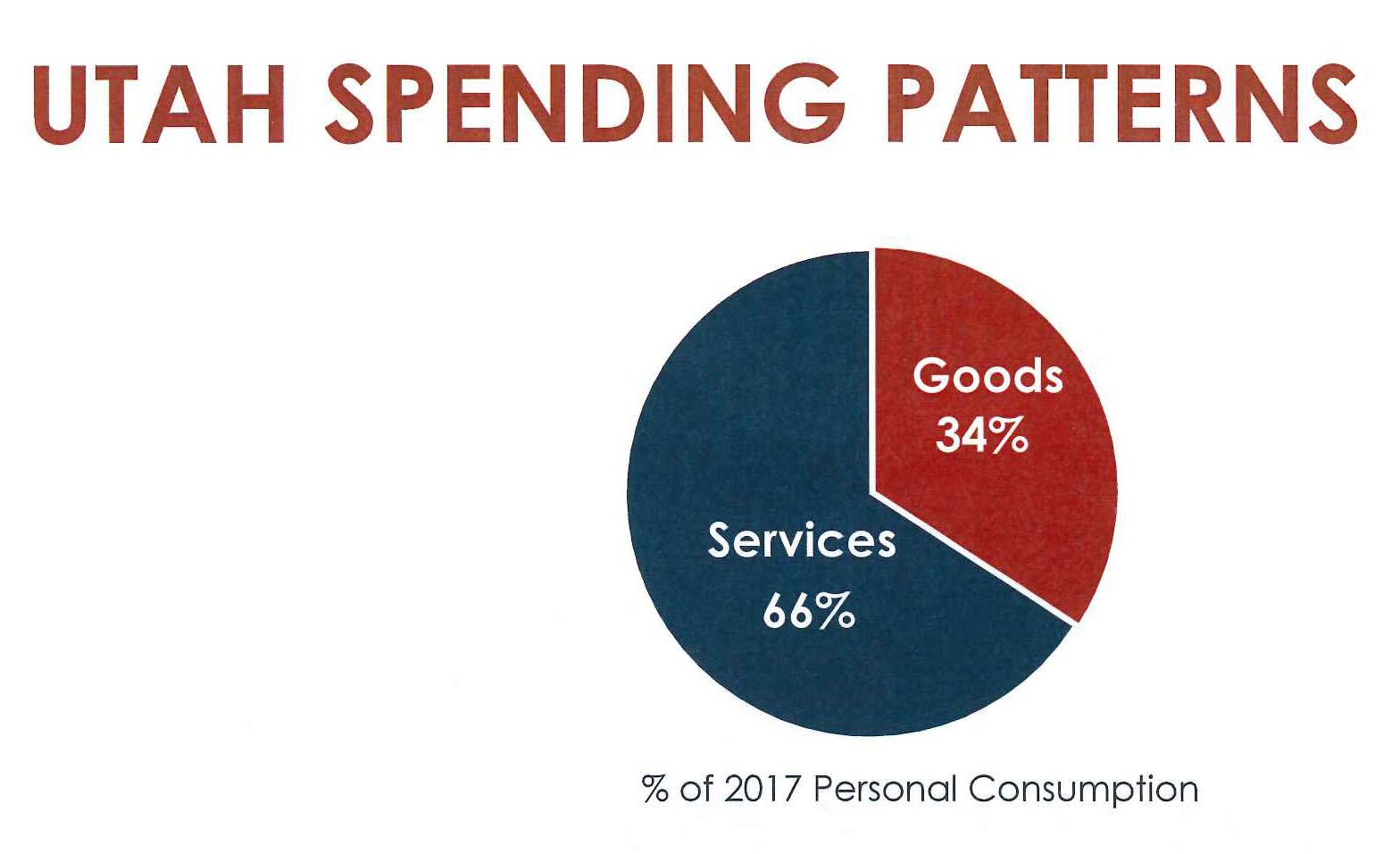

Due to Utah’s rapidly growing population and shifting demographics, there are increasing demands on the General Fund and other programs funded by sales tax. There are two primary sources of state tax income: income tax goes directly into the education fund for public education only. Sales taxes flow into the general fund to pay for everything else, like courts, social programs, air quality, Medicaid public safety, homelessness and affordable housing, general government operations and buildings, and highways. A burgeoning economy keeps pumping income taxes into the education fund. But changes in our shopping patterns have hit the general fund hard, to the point that it won’t sustain general government operations, including building highways as it has historically done. We shop for far more services than we used to, most of which incur no sales tax. In essence, sales tax is capturing a declining share of total consumption. As a result, Utah lawmakers are considering expanding sales taxes into services, not just goods.

BACKGROUND

This likely expansion of sales tax on services may work for some businesses, but certainly not all. For example, an attorney, barber and lawn care provider can pass on the added service sales tax to the consumer by simply raising the cost of doing business. In the agriculture industry, there are a number of business services with no sales tax, including: trucking, fertilizer applicators and the farm accountant. These service-based businesses can pass on the added expense. However, the family owned and operated farm business, or consumer of these services, is largely unable to pass on the increased expense.

Farmers and ranchers are in a unique position in the market place in that they are price takers, not price givers. That means they cannot pass on added costs of production to their customers. Because they produce a perishable product and operate in perhaps the most nearly-perfectly competitive market in the world they have little, if any, control over time of marketing or price.

Agriculture has long been recognized as Utah’s most basic industry. Agriculture is not just another business. In fact, the lifestyle we enjoy in this state is highly dependent upon a strong, healthy agricultural economy. Profitable conditions for our farmers and ranchers not only means that grocery store shelves will continue to be full, offering Utah’s consumers a wide variety of wholesome food at some of the lowest prices found anywhere in the world, but that a large number of businesses and jobs related to our agricultural industry will also be preserved.

UTAH AGRICULTURE

Total Utah agriculture receipts, or the market value of agricultural commodities, totaled $1.74 billion in 2017, up 4.8 percent from 2016’s 1.66 billion. Agriculture production continues to be an important economic driver accounting for $2.55 billion in total economic output when including economic multiplier effects. Combining both agriculture production and processing produces nearly 80,000 Utah jobs and $3.5 billion in compensation.

Farmers and ranchers do not produce discretionary products that somehow fill wants of society like recreation, luxury items and entertainment. Agriculture produces life-sustaining products, without which we cannot exist, let alone enjoy those luxuries of life to which we have become so accustomed. Agriculture is the reason we enjoy affluence in this state and nation.

2019 UTAH LEGISLATURE

The 2019 Utah Legislature passed House Bill 495 which creates the Tax Restructuring and Equalization Task Force. Five Utah Senators, five Utah Representatives and four tax experts will study state and local revenue systems this summer and fall and ultimately make recommendations to the Utah Legislature’s Revenue and Tax Interim Committee addressing tax structural imbalances. Task Force members include:

Senator Hillyard – https://senate.utah.gov/lyle-hillyard

Senator Cullimore – https://senate.utah.gov/kirk-cullimore

Senator Fillmore – https://senate.utah.gov/lincoln-fillmore

Senator Bramble – https://senate.utah.gov/curtis-bramble

Senator Mayne – https://senate.utah.gov/karen-mayne

Representative Gibson – https://house.utah.gov/rep/GIBSOFD/

Representative Schultz – https://house.utah.gov/rep/SCHULM/

Representative Quinn – https://house.utah.gov/rep/QUINNT/

Representative Spendlove – https://house.utah.gov/rep/SPENDRM/

Representative Briscoe – https://house.utah.gov/rep/BRISCJK/

Keith Prescott (former Utah Tax Commissioner)

Gary Cornia (Tax Attorney)

Kristen Cox (Governor’s Budget Director)

Steve Young (Tax Attorney)

Going into the summer/fall Task Force meetings, options to address the tax imbalances include:

- Broaden the sales tax and lower the sales and income tax rates. More specifically, this option includes: tax some/all services restore the sales tax on food, allow for additional time for income to come from both the Wayfair bill (effective January 1, 2019) and the Marketplace Facilitator bill (effective October 1, 2019). Both of these bills deal with the collection of sales taxes from internet sales.

- Impose a “building fund” fee on every income tax return which is a credit against income tax. Essentially, dedicate a portion of the income tax (for example, $100/home) and dedicate that collection to transportation, law enforcement, buildings, etc.

- Amend the Utah Constitution to allow income tax revenues to be spent on government programs, other than education.

- Redistribute property tax revenues.

- Phase out the motor fuel tax and replace it with the Road Usage Charge (RUC), or pay by mile.

POLICY

Consider how these options may impact your family, business and community then contact your legislator and share your concerns and possible solutions. Utah Farm Bureau supports a balanced tax policy for Utah that includes property tax, income tax, sales tax and user fees. Utah Farm Bureau also supports equalizing the food tax to the state sales and use tax rate.

TASK FORCE UPDATES

May 30, 2019

Utah Tax Restructuring and Equalization Task Force met for the first time at Utah’s Capitol Building. Rather than take public input at this initial public meeting, the co-chairs largely led a presentation outlining the history, purpose and vision of the Task Force. The declared and adopted purpose of the interim task force is: “Assure sustainable, adequate, and flexible funding to meet the needs of Utah citizens, including education, public safety, social services, transportation, recreation, and environmental quality.”

The process the task force will govern themselves will be six-fold: 1) conduct a public listening tour 2) verify challenge and needs 3) explore and consider options 4) analyze and refine options 5) recommend restructuring pathway, and 6) legislative consideration.

The task force approved eight Town Hall Meetings throughout the state:

Tuesday, June 25 Brigham City (USU Brigham City Campus, multi-purpose room, 989 S. Main st.) Open House 6 p.m., Town Hall Meeting 7 p.m.

Thursday, June 27 Salt Lake County. Chamber West Element Event Center in Kearns (5658 S. Cougar Lane (4800 West). Open House 6 p.m., Town Hall Meeting 7 p.m.

Friday, June 28 Richfield. Sevier County Fairgrounds, exhibit hall (410 E. 200 S.). Open House 5 p.m., Town Hall Meeting 6 p.m.

Saturday, June 29 St. George. Dixie Tech Auditorium & Lobby (610 S. Tech Ridge Drive) in St. George. Open House 1 p.m., Town Hall Meeting 2 p.m.

Monday, July 8 Davis/Weber County. Davis Tech Business Resource Center in Kaysville, Main conference room (450 S. Simmons Way). Open House 6 p.m., Town Hall Meeting 7 p.m.

Tuesday, July 9 Roosevelt. Crossroads Senior Center (50 E. 200 S.). Open House 6 p.m., Town Hall Meeting 7 p.m.

Saturday, July 20 Moab. Grand Center (182 N. 500 W.). Open House 1 p.m., Town Hall Meeting 2 p.m.

Tuesday, July 30 Utah County Silicon Slopes/UTC (2600 Executive Parkway, suite 240 in Lehi). Open House 6 p.m., Town Hall Meeting 7 p.m.

Want more news on this topic? Farm Bureau members may subscribe for a free email news service, featuring the farm and rural topics that interest them most!